Options Trading for Dummies: A Comprehensive Guide

Options trading can seem daunting, but resources like the “Options 101” guide offer a beginner-friendly approach.

These PDF guides comprehensively cover fundamentals, trading psychology, and strategies for new investors.

What are Options?

Options are derivative contracts, meaning their value is derived from an underlying asset – typically 100 shares of a stock. They grant the buyer the right, but not the obligation, to either buy (call option) or sell (put option) that asset at a predetermined price (strike price) before a specific date (expiration date).

Understanding options requires grasping that they aren’t direct ownership of the asset itself. Instead, they are contracts offering a choice. Resources like beginner guides, often available as PDF downloads, emphasize that options are complex, high-risk instruments.

These guides, such as “Options 101”, stress the importance of understanding how options work to mitigate potential losses. Essentially, you’re paying a premium for this right, and successful trading hinges on correctly predicting the future price movement of the underlying asset.

Understanding Derivative Contracts

Derivative contracts, like options, derive their value from something else – the underlying asset. This differs from directly owning the asset itself. Think of it as a bet on the asset’s price, rather than owning the asset. Options are a prime example, offering rights tied to future price movements.

Beginner resources, often found as PDF guides, highlight that understanding this derivative nature is crucial. The value of an option fluctuates based on changes in the underlying asset’s price, time to expiration, and market volatility.

These contracts are leveraged instruments, meaning a small price change in the underlying asset can result in a larger percentage change in the option’s price. Guides like “Options 101” emphasize that this leverage amplifies both potential profits and potential losses, making risk management paramount.

The Underlying Asset and Contract Size

The underlying asset is what the option contract is based on – typically 100 shares of a stock, but can also be ETFs, indices, or commodities. Options trading for dummies resources, often available as PDF guides, stress the importance of identifying this asset before trading.

Contract size is standardized. One options contract controls 100 shares of the underlying stock. Therefore, if an option contract for XYZ stock is priced at $2.00, the total cost to purchase the contract is $200 (plus commissions). Understanding this multiplier effect is vital.

Beginner guides like “Options 101” explain that this standardization simplifies trading and allows for easy calculation of potential profits and losses. Knowing the contract size helps traders accurately assess their potential exposure and manage risk effectively. It’s a foundational concept for anyone entering the options market.

Why Options Trading is Considered High-Risk

Options trading is often categorized as high-risk due to several factors. PDF guides aimed at options trading for dummies consistently highlight the potential for rapid and substantial losses. Unlike directly owning a stock, options have an expiration date; if the option isn’t “in the money” by then, it becomes worthless.

Leverage is a key contributor to the risk. A small price movement in the underlying asset can lead to a significant percentage gain or loss on the option premium. Furthermore, options are complex instruments requiring a solid understanding of market dynamics and various strategies.

Resources like introductory guides emphasize that improper risk management, such as inadequate position sizing or a lack of stop-loss orders, can exacerbate potential losses. It’s crucial to understand that options aren’t suitable for all investors.

Core Concepts & Terminology

Options trading for dummies PDF guides explain essential terms like “calls,” “puts,” “strike price,” and “expiration date.”

Understanding these basics is vital for successful trading.

Call Options Explained

Call options grant the buyer the right, but not the obligation, to buy an underlying asset at a specific price (the strike price) on or before the expiration date. A PDF guide for options trading for dummies will emphasize that you profit when the asset’s market price rises above the strike price, plus the premium paid for the option.

Essentially, you’re betting the price will increase. If the price stays below the strike price, the option expires worthless, and your loss is limited to the premium. These guides often illustrate this with examples, showing how to calculate potential profits and losses. Understanding this “right to buy” is fundamental.

Beginner resources highlight that call options are often used when an investor is bullish – meaning they expect the underlying asset’s price to go up. They are a leveraged way to participate in potential price increases, offering higher potential returns (but also higher risk) than directly owning the asset.

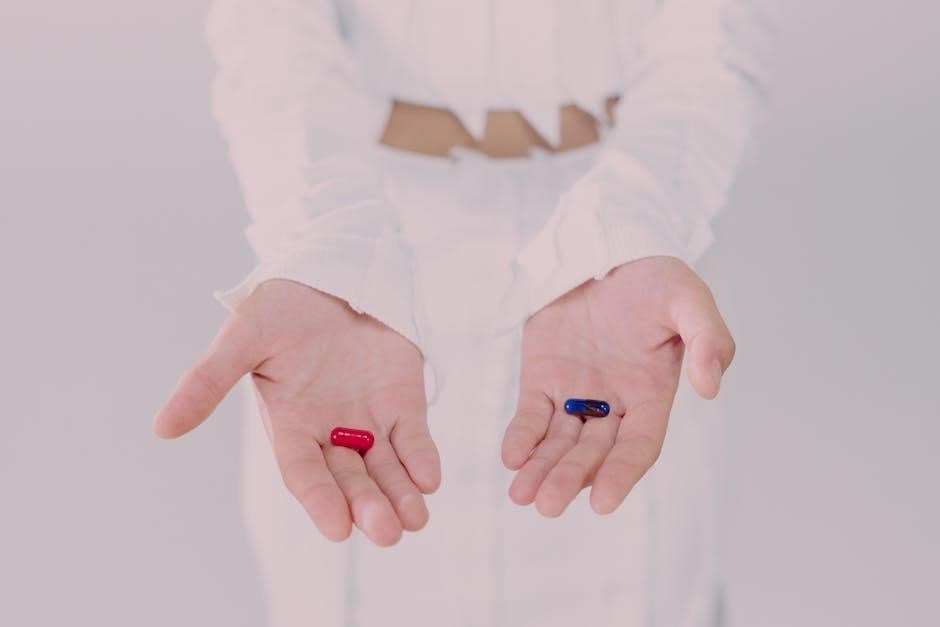

Put Options Explained

Put options give the buyer the right, but not the obligation, to sell an underlying asset at a predetermined price (the strike price) before or on the expiration date. A comprehensive options trading for dummies PDF will explain that profit is realized when the asset’s market price falls below the strike price, minus the premium paid.

You’re essentially betting the price will decrease. If the price remains above the strike price, the option expires worthless, limiting your loss to the premium. These guides often use clear examples to demonstrate profit/loss scenarios. Understanding this “right to sell” is crucial.

Beginner resources emphasize that put options are typically used when an investor is bearish – anticipating a price decline. They offer a leveraged way to profit from falling prices, potentially yielding higher returns (and risks) than short-selling the asset directly.

Strike Price and Expiration Date

A solid options trading for dummies PDF will thoroughly explain two critical components: the strike price and the expiration date. The strike price is the predetermined price at which the underlying asset can be bought (call) or sold (put) when exercising the option. It’s a key factor in determining potential profit or loss.

The expiration date is the final day the option is valid. After this date, the option becomes worthless if not exercised. These dates are standardized, typically the third Friday of the month. Understanding these dates is vital for timing your trades.

Beginner guides emphasize that the relationship between the strike price, current market price, and expiration date significantly impacts the option’s premium. Resources will often illustrate how these elements interact, providing practical examples for new traders to grasp these core concepts.

Option Premium: What You Pay

A comprehensive options trading for dummies PDF will dedicate significant attention to the option premium – essentially, the price you pay to buy an option contract. This isn’t the price of the underlying asset, but rather the cost of the right, but not the obligation, to buy or sell it at a specific price.

Several factors influence the premium, including the strike price, time until expiration, volatility of the underlying asset, and interest rates. Beginner guides often break down these influences with clear explanations and examples.

Understanding that the premium represents the maximum potential loss for buyers is crucial. PDF resources will highlight this, emphasizing that while potential profits can be unlimited (for buyers of calls), the premium is the most you can lose. It’s a fundamental concept for risk management.

Basic Options Strategies

Options trading for dummies PDF guides introduce core strategies like buying calls and puts, covered calls for income, and protective puts to limit risk.

Buying Call Options: A Beginner’s Approach

Buying call options represents a fundamental strategy, often recommended in options trading for dummies PDF guides. This approach allows investors to gain leveraged exposure to an underlying asset, anticipating its price will increase before the expiration date. A call option grants the buyer the right, but not the obligation, to purchase the asset at a predetermined strike price.

The potential profit is theoretically unlimited, as the asset’s price can rise indefinitely. However, the maximum loss is limited to the option premium paid. PDF resources emphasize that beginners should start with buying calls due to their relatively straightforward nature. Understanding the relationship between the asset price, strike price, and premium is crucial.

These guides often illustrate this strategy with examples, highlighting the importance of selecting an appropriate expiration date and strike price based on your market outlook. Remember, careful research and risk management are paramount when employing this strategy.

Buying Put Options: Protecting Your Portfolio

Buying put options is frequently presented in options trading for dummies PDF guides as a key strategy for portfolio protection. A put option gives the buyer the right, but not the obligation, to sell an underlying asset at a specific strike price before the expiration date. This is particularly useful when anticipating a potential market downturn or a decline in the price of a stock you already own.

Essentially, it acts as insurance against losses. The maximum loss is limited to the option premium paid, while the potential profit is substantial if the asset price falls significantly. PDF resources often explain how put options can be used to hedge existing positions, limiting downside risk.

Beginners are advised to understand the concept of “protective puts” and how they differ from simply selling the underlying asset. Careful consideration of strike price and expiration date is vital for effective portfolio protection.

Covered Calls: Generating Income

Covered call strategies are frequently detailed in options trading for dummies PDF guides as a relatively conservative income-generating technique. This involves selling call options on stock you already own – hence the term “covered.” By selling a call, you grant the buyer the right to purchase your shares at a specific strike price before the expiration date.

In return, you receive an option premium, providing immediate income. This strategy is best suited for investors who believe the stock price will remain stable or increase modestly. The upside potential is capped at the strike price, as you may be obligated to sell your shares if the option is exercised.

PDF resources emphasize that covered calls are less risky than buying calls or puts outright, but still involve risk. Understanding the trade-offs between income generation and potential capital appreciation is crucial for success.

Protective Puts: Limiting Downside Risk

Protective puts, often explained in options trading for dummies PDF guides, are a strategy used to safeguard existing stock holdings against potential price declines. This involves purchasing put options on shares you already own. The put option gives you the right, but not the obligation, to sell your shares at a predetermined strike price before the expiration date.

Essentially, you’re buying insurance for your portfolio. If the stock price falls below the strike price, your put option increases in value, offsetting some of your losses. The cost of this protection is the option premium you pay upfront.

PDF resources highlight that while protective puts limit downside risk, they also reduce potential upside gains, as the premium paid represents a cost. It’s a valuable strategy for risk-averse investors seeking to protect their investments during uncertain market conditions.

Risk Management in Options Trading

Options trading for dummies PDF guides emphasize crucial risk management. Understanding volatility, position sizing, and utilizing stop-loss orders are key to minimizing potential losses.

Understanding Volatility

Volatility is a cornerstone of options trading, and resources like options trading for dummies PDF guides dedicate significant attention to its comprehension. As traders, we prioritize predicting a stock’s volatility during the trade’s lifespan, not just its past performance.

Historical Volatility provides insight into past price fluctuations, offering a baseline understanding. However, it’s crucial to remember that past performance isn’t indicative of future results.

Options trading for dummies materials stress that traders must assess how likely a stock is to move significantly within a specific timeframe. This assessment directly impacts option pricing and strategy selection. Higher volatility generally translates to higher option premiums, reflecting the increased risk and potential reward.

Successfully navigating options requires a grasp of volatility’s nuances, and beginner guides provide the foundational knowledge to begin this journey.

Historical Volatility vs. Implied Volatility

Options trading for dummies PDF guides emphasize the critical distinction between Historical Volatility and Implied Volatility. Historical volatility, as the name suggests, analyzes past price movements over a defined period, providing a statistical measure of a stock’s price fluctuations. It’s a rearview mirror look at volatility.

Implied Volatility, however, is forward-looking. It’s derived from option prices themselves, reflecting the market’s expectation of future price swings. A higher option price suggests greater implied volatility, indicating traders anticipate significant movement.

Understanding this difference is vital. While historical volatility offers context, implied volatility is more directly relevant to current option pricing and strategy decisions. Options trading resources highlight that discrepancies between the two can present trading opportunities.

Beginner guides stress that skilled traders analyze both to gauge market sentiment and potential profitability.

The Importance of Position Sizing

Options trading for dummies PDF resources consistently underscore the paramount importance of position sizing. It’s arguably the most crucial aspect of risk management, often overlooked by beginners. Simply put, position sizing determines how much capital you allocate to a single trade.

A common mistake is risking too much on any one trade, potentially wiping out a significant portion of your account with a single unfavorable outcome. Guides recommend a conservative approach, typically risking only 1-2% of your total trading capital per trade.

Proper position sizing isn’t about limiting potential profits; it’s about preserving capital and ensuring longevity in the market. Options trading involves inherent risks, and even the best strategies can experience losses.

By carefully controlling position size, you can weather losing streaks and remain in the game to capitalize on future opportunities.

Setting Stop-Loss Orders

Options trading for dummies PDF guides universally emphasize the critical role of stop-loss orders in safeguarding your capital. These orders automatically execute a trade when the price reaches a predetermined level, limiting potential losses.

Unlike simply hoping a trade will turn around, a stop-loss provides a disciplined exit strategy. Determining the appropriate stop-loss level requires considering factors like volatility, the underlying asset’s price action, and your risk tolerance.

Many resources suggest placing stop-losses based on technical analysis, such as support and resistance levels. For example, a stop-loss might be set slightly below a key support level for a long call option.

Remember, a stop-loss isn’t a guarantee against losses, but it’s a vital tool for managing risk and preventing catastrophic outcomes.

Ignoring stop-losses can quickly erode your trading account.

Advanced Options Strategies (Brief Overview)

PDF guides for options trading for dummies briefly introduce strategies like straddles, strangles, and spreads. These require a solid understanding of core concepts.

Straddles and Strangles

Straddles and strangles are advanced options strategies often discussed in comprehensive options trading for dummies PDF guides. Both involve buying a call and a put option simultaneously, but differ in their strike prices.

A straddle utilizes the same strike price for both options – typically at-the-money. Traders employ this when anticipating significant price movement, but are unsure of the direction. Profit is realized if the underlying asset’s price moves substantially in either direction, exceeding the combined premium paid.

Conversely, a strangle employs different strike prices: an out-of-the-money call and an out-of-the-money put. This strategy is cheaper to implement than a straddle, but requires a larger price swing to become profitable. PDF resources emphasize that these strategies are best suited for experienced traders due to their complexity and potential for loss.

Understanding the nuances of each, including volatility implications, is crucial before implementation.

Bull Call Spreads

Bull call spreads are a popular options strategy detailed in many options trading for dummies PDF guides, designed for moderately bullish investors. This strategy involves simultaneously buying a call option with a lower strike price and selling a call option with a higher strike price, both with the same expiration date.

The goal is to profit from a limited price increase in the underlying asset. The cost of the spread is the difference in premiums paid and received. Maximum profit is capped at the difference between the strike prices, less the net premium paid.

PDF resources highlight that bull call spreads reduce the cost of a long call option, but also limit potential gains. This strategy is considered less risky than simply buying a call option, making it suitable for beginners seeking defined risk. Careful consideration of volatility and potential price ranges is essential.

Bear Put Spreads

Bear put spreads, frequently explained in options trading for dummies PDF guides, are a strategy employed when an investor anticipates a moderate decline in the price of an underlying asset. This involves buying a put option with a higher strike price and simultaneously selling a put option with a lower strike price, both sharing the same expiration date.

The maximum profit is limited to the difference between the strike prices, less the net premium paid. The net premium represents the cost of establishing the spread. PDF resources emphasize that this strategy benefits from a decrease in the asset’s price, but caps potential gains.

Compared to simply buying a put option, a bear put spread reduces the initial cost but also limits the maximum profit. It’s a defined-risk strategy, making it appealing to beginners. Understanding volatility and accurately predicting the downward price movement are crucial for success.

Resources for Further Learning

PDF guides like “Options 101” are excellent starting points. Explore free online guides, reliable websites for market analysis, and recommended books for deeper knowledge.

Free Online Options Trading Guides

Numerous online resources cater to beginners seeking to understand options trading without a significant financial investment. Many brokerage firms, like eToro, offer introductory guides explaining the basics of options, including terminology and core strategies. These guides often break down complex concepts into digestible segments, making them ideal for those new to derivatives.

Furthermore, several websites compile free educational materials, often including articles, videos, and interactive tutorials. Searching for “options trading for dummies” will yield a wealth of information, including downloadable PDF guides; These PDF resources, such as those referenced as “Options 101,” frequently cover fundamental definitions, different strategies, and actionable advice for individual investors.

However, it’s crucial to critically evaluate the source and ensure the information is current and accurate. Always cross-reference information from multiple sources before making any trading decisions. Remember that free guides are a great starting point, but may not offer the depth of paid courses or personalized mentorship.

Recommended Books on Options Trading (e.g., “Options 101”)

For a structured learning experience, several books are highly recommended for those venturing into options trading. “Options 101” by Steve Burns and Holly Burns is frequently cited as an excellent starting point, offering a comprehensive overview of the options market and its mechanics. This book, often available as a PDF download, simplifies complex concepts for beginners.

Other valuable resources include texts that delve into specific strategies and risk management techniques. While a definitive list varies, many traders appreciate books that combine theoretical knowledge with practical examples. These resources often provide detailed explanations of call and put options, strike prices, expiration dates, and the crucial role of volatility.

Before purchasing, consider reading reviews and assessing the author’s credentials. A well-written book will not only explain what options are but also why certain strategies work and the potential risks involved. Remember to supplement book learning with practical experience and ongoing market analysis.

Reliable Websites for Market News and Analysis

Staying informed is paramount for successful options trading, and numerous websites provide valuable market news and analysis. While a PDF guide like “Options 101” builds foundational knowledge, real-time data and expert opinions are crucial for informed decision-making. Reputable financial news outlets consistently deliver updates on economic indicators, company performance, and market trends.

Websites offering options-specific analysis can help identify potential trading opportunities and assess risk. Look for platforms that provide volatility data, implied volatility calculations, and options chain analysis. Be cautious of sources promoting specific strategies without acknowledging potential downsides.

Remember to cross-reference information from multiple sources to gain a balanced perspective. Reliable websites prioritize accuracy and transparency, offering unbiased reporting and avoiding sensationalism. Supplementing your learning with current market insights is essential for navigating the complexities of options trading.

PDF Guides and Resources Availability

Numerous resources are available in PDF format to aid beginners in understanding options trading. A frequently recommended resource is “Options 101” by Steve Burns and Holly Burns, offering a comprehensive introduction to the stock market and options strategies. This guide covers fundamental definitions and provides actionable advice for those starting their options trading journey.

Many brokerage firms also offer free downloadable guides and educational materials on their websites. These resources often cover basic terminology, options strategies, and risk management techniques. Searching online for “options trading beginners guide PDF” yields a wealth of results, but always verify the source’s credibility.

Be mindful of the publication date, as market conditions and regulations can change. While PDF guides provide a solid foundation, remember to supplement your learning with current market news and analysis for optimal results.